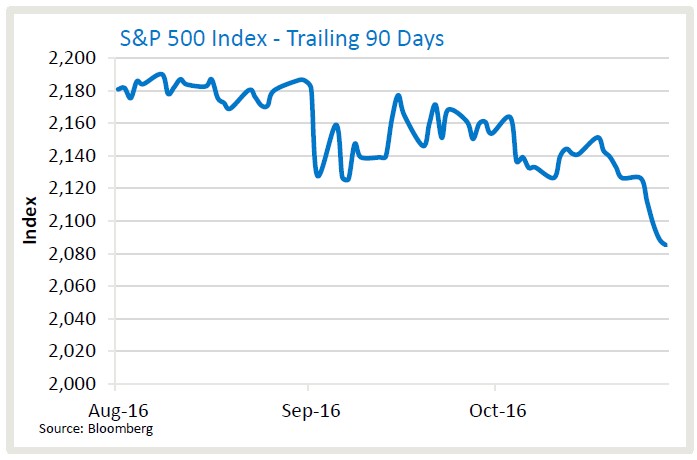

At this point in time I think it is important that we keep things in perspective. I understand concerns over the election remain high but I think many are looking at the U.S. election based on what happened after Brexit. People assumed Brexit wouldn’t happen and when it did, there was a sharp two-day selloff. Keep in mind that this was only two days and the markets came back strongly afterwards. Leading up to the U.S. election has been quite different. August, September and October each saw modest declines as has each of the last 9 trading days as of Friday. While the declines each day have been modest, this is the first time we have seen nine consecutive down days since 1980. This is despite better economic data.

I’m not endorsing either candidate but I want to impress that I believe with the selloff so far we are less likely to see a large selloff immediately after the election. I believe if Clinton wins but Republicans remain control congress, we may see a sharp bounce immediately following the election. If Trump wins or if Hillary wins and the Democrats sweep the Senate and the House we may see some degree of selloff immediately following the election but likely not a Brexit scale event. In either case, I believe there is a case for a market bounce back after a few days from the election. Again, I’m not endorsing either candidate. However, I understand that markets hate uncertainty. Normally, I place very little emphasis on the election but this one has created more than the usual amount of uncertainty. I would just recommend not to let emotions control your decisions.

This past week saw a good but not too strong October employment growth. Wages are strong and this should help consumer spending. U.S. Treasury yields fell after the run-up the past few weeks. Commodity prices fell and oil fell sharply on a surprise record rise in inventories. The U.S. dollar also gave back some of its recent rise. The U.S. trade deficit improved as did manufacturing numbers in the U.S. and Asia.

In the numbers this week:

- Factset reported that with 85% of S&P 500 companies reporting, 3rd earnings have grown 2.7%.

- The U.S. Energy Information Administration reported:

- Crude oil inventories 14.4MM barrels the largest weekly increase in over 30 years.

- Gasoline inventories fell 2.2MM barrels.

- Crude oil production rose 18,000 barrels per day.

- Baker Hughes reported that oil drilling rigs rose by 9 to 450 and gas drilling rigs rose 3 to 117.

- The Labor Department reported

- Initial jobless claims rose 7,000 in the prior week to a seasonally adjusted 265,000. The four-week moving average of claims rose 4,750 to 257,750. Claims have now run below the 300,000 level for 87 weeks.

- Nonfarm business productivity rose at a 3.1% seasonally adjusted annual rate in the third quarter. Productivity in prior quarters had been negative. Despite this increase from a year ago productivity is unchanged.

- The U.S. added 161,000 jobs in October and revised September’s gains up to 191,000. The unemployment rate fell to 4.9%.

- Average hourly earnings in the private sector rose 2.8% October from a year ago.

- The Commerce Department reported

- Personal consumption rose 0.5% in September.

- Income rose 0.3% in September.

- The U.S. trade gap shrank 9.9% in September. This was due to a combination of rising exports and falling imports. Agricultural exports, especially soybeans were very strong. The fall in imports from August to September was largely due to payments for Olympic broadcast rights in August.

- Asian purchasing manager’s indexes turned positive showing acceleration in manufacturing:

- China Caixin manufacturing PMI rose from 50.1 in September to 51.2 October.

- Japan’s manufacturing PMI rose from 50.4 in September to 51.4 in October.

- Taiwan’s manufacturing PMI rose from 52.2 in September to 52.7 in October.

- South Korea’s manufacturing PMI rose from 47.6 in September to 48.0 in October. South Korea is one of the few Asian countries with decelerating manufacturing, albeit at a slower pace.

- The Institute for Supply Management reported:

- S. ISM Manufacturing index rose from 51.5 in September to 51.9 in October.

- S. Non-Manufacturing index fell from 57.1 in September to 24.8 in October.

Please call us if you have any questions.

Loren C. Rex, CFP®, AIF®, MA Erik Smith

President Partner

Generations Financial Planning & Wealth Management 269-441-4143

77 E. Michigan Ave, Suite 140

Battle Creek, MI 49017

Tel 269-441-4090

Carrie Fuce, Assistant 269-441-4091

Toll Free: 800-513-8180

Fax 866-381-2301

Visit our Website: www.genfinplan.com

Registered Representative of and securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and Generations Financial Planning & Wealth Management are separate companies and are not affiliated.

These are the opinions of Loren Rex and Erik Smith and are not necessarily those of Cambridge, are for informational purposes only, and should not be construed or acted upon as individualized investment advice.